Has Business Investment Credit For Solar Panels Expired

48 one may reasonably assume that the irs would take a position consistent with letter ruling 201523014 and only permit the incremental costs as defined in regs.

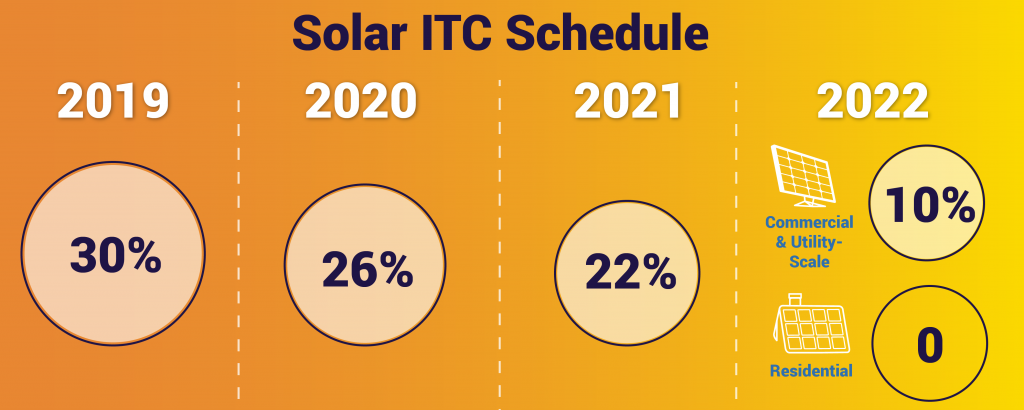

Has business investment credit for solar panels expired. Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes. This means you can still get a major discount off the price for your solar panel system. Safe harbor for taxpayers that develop renewable energy projects 29 may 2020. Thanks to the popularity of the itc and its success in supporting the united states transition to a renewable energy economy congress has extended its expiration date multiple times.

48 provides for a solar energy tax credit for the installation of solar panels as part of the general business credit under sec. After 2021 businesses can receive a 10 tax credit for installing solar panels. You subtract this credit directly from your tax. Commercial and utility scale projects which have commenced construction before december 31 2021 may still qualify for the 30 26 or 22 percent itc if they are placed in service before december 31 2023.

Here are the specifics. Department of energy solar energy technologies office supports early stage research and development to improve the affordability reliability and performance of solar technologies on the grid. 1 48 9 k to be included in calculating the energy credit when adding a new roof and solar panels to the property. Additional relief for rehabilitation credit deadlines 30 jul 2020.

The tax credit remains at 30 percent of the cost of the system. The form you use to figure each. Preliminary activities on site e g clearing the site photo credit dennis schroeder nrel the u s. After 2021 the residential credit drops to zero while the commercial credit drops to a permanent 10 percent.

Recent legislation has retroactively impacted the 2018 instructions for form 3468 10 feb 2020. All of the following credits with the exception of the electric vehicle credit are part of the general business credit. 48 is more favorable. For commercial solar energy under sec.

However if you can t pay for a solar panel setup up front you may be eligible for affordable financing options. 25d does not allow a solar tax credit for the cost of installing solar panels for use in residential rental property sec. In addition your general business credit for the current year may be increased later by the carryback of business credits from later years. Physical work has to be integral to the project.

That credit drops to 22 next year and is set to expire at the end of 2021.